Hercules Investments, an RIA/hedge fund based in Los Angeles, CA, with about $150 million investment plan for the post-pandemic recovery,which will be in direct control of the management.

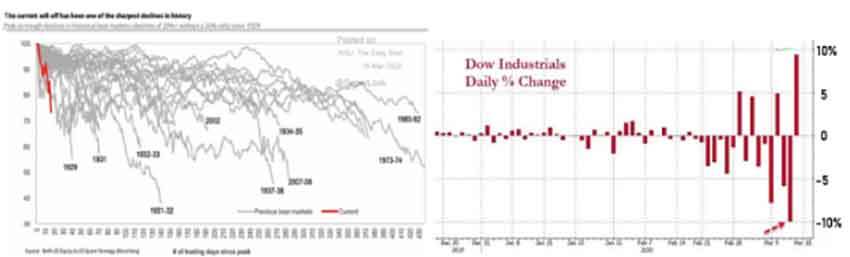

In the 30 days since the threat of coronavirus contagion caught up with US Equity markets, we find ourselves deep into bear market territory, with the S&P 500 (SPX), Nasdaq 100 (NDX) and the Dow 30 (DJIA) being 33%, 30% and 36% off their 52-week highs. Moreover, we have witnessed the fastest collapse from peak to bear market in history, reflected in the record levels in the VIX volatility index, higher than the peak during the Lehman bankruptcy during the 2008 financial crisis.

The coronavirus outbreak continues to spread across the U.S. According to the Worldometer data tracker, the number of confirmed U.S. cases continues to grow with at least 14,239 cases with at least 217 deaths. Meanwhile, global confirmed coronavirus cases topped 245,660 with more than 10,049 deaths.

The fight against Covid-19 is an all out war. While countries in the East have had success in mitigating the outbreak, likely due to their experiences in dealing with the SARS epidemic, Europe and the US have been slow to mobilize and are consequently paying a higher price. Judging by the experience in Italy, the US is still in the earlier stages of its fallout and cases of new infections and death rates will escalate in the coming weeks. The Chinese and South Korean experience, so far, has shown that putting strong curbs on human interaction is the best form of defence. It has massively widespread economic consequences but there is no option now but to have to hurt the economy to stop the virus. The damage is probably going to be temporary, and we expect to see a recovery in the back half of this year. This is coincidentally in line with the consensus forming among strategists at leading investment banks. They expect 2020’s first quarter GDP growth in the -4 to -6% range, followed by a 2nd quarter drop of an additional -15% on average, and a sharp rebound to a +8% growth in Q3, 2020. Our view is supported by the counter intuitive action in the Shenzhen Composite index over the past 2 weeks, as it is up nearly 13% year to date despite surveys showing small businesses suffering revenue damage from the virus.

Markets are forward looking, and it is reasonable to assume stocks will bottom before US coronavirus cases peak. A peak in new cases of infection in Italy will allow US markets to stabilize as investors will get a better handle on the disease cycle. Despite the apparently outsized drawdown in the equity market indices so far and the search for a near-term bottom around the 20,000 level in the DJIA in the last 2 days, we are likely to see a further fall with a flush-out move before the markets present compelling opportunities. Our view includes an extreme scenario of the DJIA falling all the way to the 15,000 level.

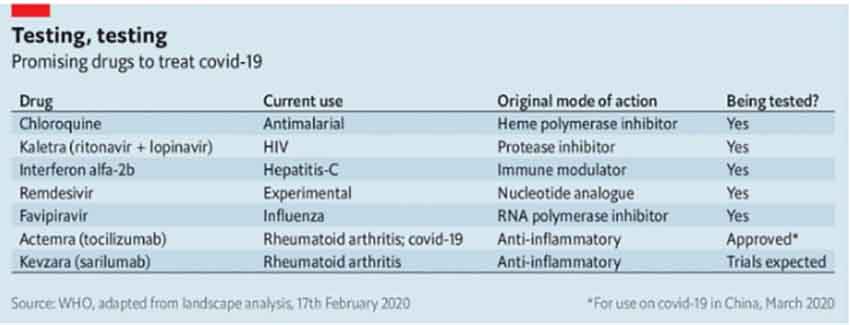

As dire as the current situation may be, there are many reasons to be optimistic about a short lived contagion followed by a rapid recovery. Firstly, while governments and healthcare agencies in the West have been relatively slow and unsure in their response, the medical and research establishments worldwide have been proactive in testing and validating effective cures. Most promising among them are the results of a trial conducted by French researchers that show a combination of an anti-malarial drug and an antibiotic (Azithromycin) as demonstrating a 100% cure date within 6 days with a 99.9999% degree of confidence. The medical establishment in China has validated the effectiveness of a Japanese drug, Favipiravir, through their recent experience in treating patients. There are other instances of success using other approaches with existing drugs.

China's 1st COVID-19 vaccine, created by the Academy of Military Medical Sciences, has been approved for clinical trials starting this week.

A strong US response has finally been mobilized. It started with the Federal Reserve slashing the Fed Funds rate in aggressive 0.5% increments, twice in a span of 2 weeks earlier this month. It also announced a $700 billion liquidity injection which in combination with US$ swaps with the major developed economy currencies, has provided ample liquidity to prevent solvency issues among banking and financial institutions. The Fed also announced the activation of two significant credit facilities for the commercial paper market and primary dealer liquidity to prevent the economic fallout from affecting the banking and financial markets.

US president Donald Trump has declared a national state of emergency. Congress has approved an $8.3 billion emergency program to fund efforts to contain the epidemic. Some are awaiting passage through the Senate. The federal government has also barred foreign travelers. Many state and city governments have announced curfews and lockdowns in an effort to maximize social distancing and “flattening the contagion curve,” as the latter has been recognized as the most effective measure of containment.

Positioning for the Post-pandemic Recovery

With considerable fiscal stimulus coming down the pipeline, and the Federal Reserve cutting rates, upping its asset purchase programs and considering small business relief packages, once the virus passes, the economy will have a lot of firepower for a rebound, as record low borrowing costs and aid could fuel record high spending.

At the same time, equity valuations have approached more reasonable valuations and stand to recapture a lot back in a V-shaped recovery. This is particularly true for the technology sector as it has fared marginally better in this downturn.

With this perspective we have created a Crisis Opportunity Strategy with the objective of generating strong and sustained growth over the intermediate to long term in following the post-2008 Financial Crisis recovery playbook. Back then, blue chip bellwethers trading at book value produced generational returns in the longest running bull market in history.

The strategy focuses on domestic sectors of the US equity market offering the potential of maximum upside, as well as developing and emerging economies and alternative pockets of opportunity that stand to gain the most.

Within the Technology sector, we plan to invest in Software and Services, Artificial Intelligence and Big Data, Enterprise and Cloud Computing and Cybersecurity. These niche areas represent markets that are expected to grow 15-30% per year over the next 5 years. Online retail has held up very well on a relative basis through the downturn, with Amazon, Walmart and Costco setting examples. Online e-commerce opportunities have played a significant role among our growth strategies and will continue to be emphasized in the recovery.

Among alternatives, we like palladium and platinum as plays for the secular increase in their industrial demand and a shrinking surplus. Coal presents itself as a value play after a confluence of multiple headwinds.

Among overseas markets, Taiwan, Singapore, Vietnam and Thailand represent attractive destinations as the global supply chain gets incrementally redistributed away from China. Brazil and Russia represent extreme value that may be opportunistically taken advantage of.

Any recovery, particularly one that is quick, will create the conditions for a fresh bull cycle. The retrenchment in economic activity we will witness in the coming two quarters will be historic and the Federal Reserve and Congress is incrementally responding to extents that far exceed the accommodation during the 2008 Financial Crisis. Once we see an inflection in the climb of infection rates in Italy, the markets are likely to start anticipating a similar inflection here. With the first signs of containment, the preponderance of excess liquidity and stimulus in the face of receding risks, will ignite the markets. The resulting recovery will be one that generates cumulative returns to achieve one’s investment goals

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.