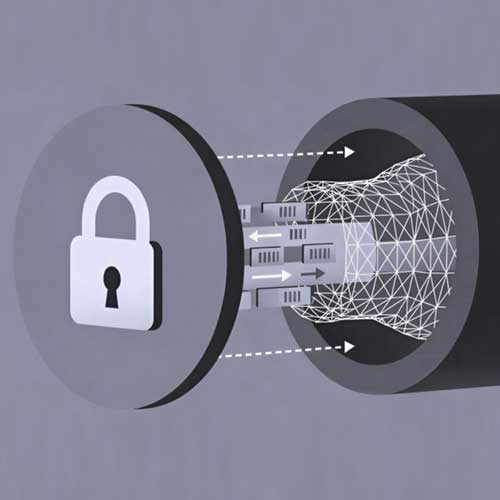

Tokenisation technology replaces sensitive card information with a unique identifier, or "token," which is tied to the user's card, the device used, and the requestor of the token

In a significant move to enhance user experience and security, PhonePe has introduced a device tokenisation feature for credit and debit card transactions. This feature allows users to tokenize their card details directly within the PhonePe application, providing a seamless and secure experience across services like bill payments, recharges, travel bookings, and insurance purchases.

Tokenisation technology replaces sensitive card information with a unique identifier, or "token," which is tied to the user's card, the device used, and the requestor of the token. This ensures that the actual card details are never shared with merchants during transactions, reducing the risk of fraud and offering enhanced contactless payment security. According to the Reserve Bank of India (RBI), tokenised transactions are more secure because they minimize the exposure of sensitive card data.

Seamless payments and increased security

For users, this new feature translates into a smoother checkout process, eliminating the need to enter card details or CVV codes for every purchase. This reduces friction during digital transactions, which in turn leads to higher success rates and fewer drop-offs. It also provides an added layer of security for debit card tokenisation, as users no longer have to store or share their card information on multiple merchant platforms.

The benefits of tokenisation go beyond just security. PhonePe’s tokenisation service, initially available for Visa credit and debit cards, supports a wide range of use cases, including bill payments, recharges, and bookings on its platform. As part of its long-term strategy, PhonePe plans to expand its offerings by integrating more card networks into the tokenisation service. The platform will also make tokenised cards available to all online merchants using its payment gateway, thereby further enhancing the security and convenience of digital transactions across the ecosystem.

PhonePe’s co-founder and CTO, Rahul Charihttps://in.linkedin.com/in/rahulchari, emphasized that the launch of this device tokenisation solution reflects the company’s ongoing commitment to driving innovation and improving customer trust. "By integrating tokenisation, we’re enhancing contactless payment security and making digital payments more convenient for millions of users," he said.

PhonePe's digital payment growth

With over 590 million registered users and more than 40 million merchants, PhonePe continues to lead India’s digital payments revolution. The tokenisation feature positions the platform at the forefront of digital transaction security, making it one of the first companies to offer direct tokenisation solutions for consumers and merchants alike.

In a related development, PhonePe also announced its exit from the account aggregator business, surrendering its NBFC-AA licence to the RBI. The company attributed this decision to challenges in onboarding enough financial information providers (FIPs) due to competing business priorities. However, PhonePe remains dedicated to strengthening its core payments business and continuing to innovate in the digital payments landscape.

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.