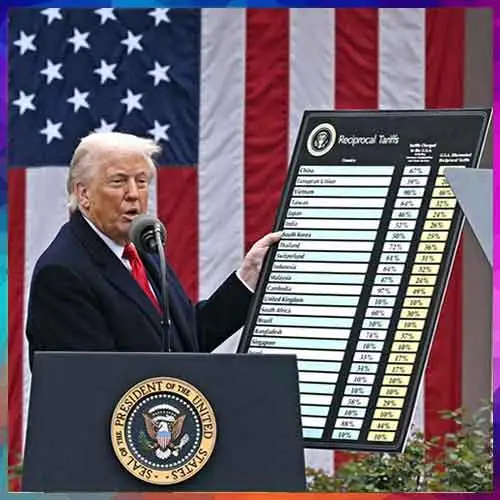

The U.S. Treasury bonds, serving as a global benchmark for pricing financial instruments, experienced unusual activity following the US President, Donald Trump's tariff announcement, significantly influencing policy reversal.

The Rising yields, contrary to typical market behaviour, signalled investor alarm.

This deviation, with the 10-year yield climbing and 30-year bonds briefly exceeding 5%, triggered worries of a broader financial crisis.

The bond market's reaction, characterized by a simultaneous drop in bond and stock prices, indicated severe economic instability.

Such a pattern, as noted by economists, is not typical, and raised concerns about potential stag-flation.

The surge in yields increased borrowing costs for both the U.S. government and corporations, impacting consumer rates and hindering economic growth.

Global investors, particularly those holding substantial U.S. debt, expressed apprehension about escalating trade tensions.

Fears of a mass sell-off, especially from nations like China, threatened to destabilize the bond market.

The U.S. government, heavily reliant on the bond market for financing its massive debt, became acutely sensitive to investor sentiment.

The abrupt tariff pause demonstrated the bond market's influence, overshadowing stock market volatility.

Analysts emphasized that rising Treasury yields, due to investor sell-offs to cover stock losses and margin calls, played a critical role in the administration's decision.

Some governments reportedly offloaded U.S. debt in protest, adding to market uncertainty.

The bond market's response, signalling fears of recession and inflation, prompted a policy shift.

The unusual activity in Treasury yields, used to price mortgages and derivatives, raised the risk of defaults by financial institutions, further highlighting the market's power in influencing economic policy.

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.