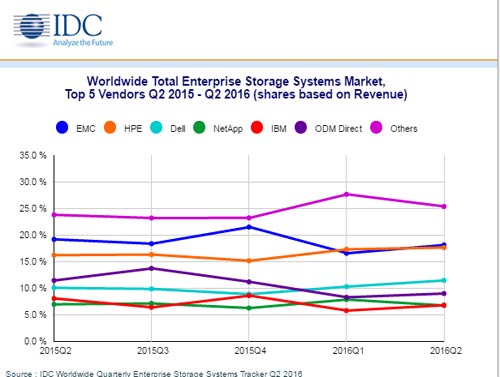

The total worldwide enterprise storage systems factory revenue remained flat year over year and posted $8.8 billion during the second quarter of 2016 according to IDC.

The total worldwide enterprise storage systems factory revenue remained flat year over year and posted $8.8 billion during the second quarter of 2016 according to IDC.

As per IDC Worldwide Quarterly Enterprise Storage Systems Tracker the total capacity shipments were up 12.9 per cent year over year to 34.7 exabytes during the quarter.

Revenue growth declined within the group of original design manufacturers (ODMs) that sell directly to hyperscale data centers. This portion of the market was down 21.5 per cent year over year to $794.7 million.

Sales of server-based storage were up 9.8 per cent during the quarter and accounted for almost $2.4 billion in revenue. External storage systems remained the largest market segment, but the $5.7 billion in sales represented flat year-over-year growth.

"After a slow start to the year, the enterprise storage system market remained steady during the second quarter," said Liz Conner, research manager, Storage Systems.

"Spending on all flash deployments continues to grow and help drive the market. The decreasing cost of flash media, coupled with increasing use cases, high density deployments, and availability of flash-based storage products, have resulted in rapid adoption throughout the market," added Conner.

EMC and HPE remained in a statistical tie for the top position within the total worldwide enterprise storage systems market, accounting for 18.1 per cent and 17.6 per cent of spending respectively.

HPE's year-over-year growth rate as reported by IDC was impacted by the start of the H3C partnership in China that began in May of 2016; as a result, a portion of HPE-designed storage systems were rebranded for the China market and do not count in HPE's market data from that point forward.

Dell held the next position with a 11.5 per cent share of revenue during the quarter. IBM and NetApp accounted for 6.8 per cent and 6.7 per cent of global spending respectively.

As a single group, storage systems sales by original design manufacturers (ODMs) selling directly to hyperscale data center customers accounted for 9 per cent of global spending during the quarter.

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.