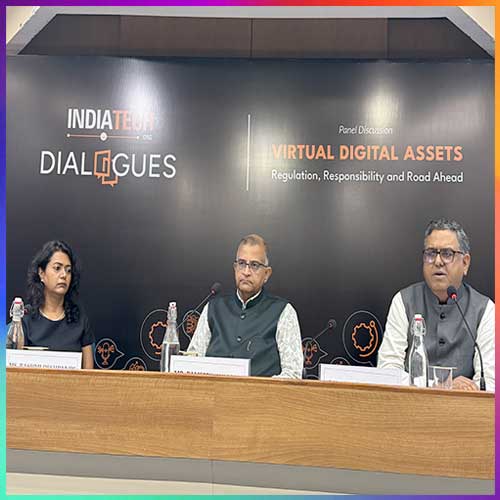

In a recently held brain storming session followed by a panel discussion session organised by INDIATECH on Virtual Digital Assets: Regulation, Responsibility, and the Road Ahead" was held by INDIAtech.org. The panel featured four experts who shared their insights: Ms. Rashmi Deshpande, Founder and Managing Advocate at Fountainhead Legal, Mr. Rameesh Kailasam, President & CEO of IndiaTech.org, Mr. Sanjay Saxena, Co-Founder & CEO of CIFDAQ India and Mr. Chirayu Bagree, Legal Counsel at 9Point Capital (who joined the discussion online) .The session provided a platform for an in-depth exploration of the challenges and opportunities in the virtual digital assets space, focusing on the need for a balanced regulatory framework and a clear path forward for the industry.

In July 2024, Indian crypto exchange WazirX suffered one of the largest security breaches in the industry. Hackers compromised a multi-signature wallet, stealing $230–235 million in cryptocurrencies—nearly a third of the exchange’s reserves. A joint statement by the U.S., South Korea, and Japan later attributed the attack to North Korea’s Lazarus Group, a state-sponsored hacking unit known for targeting financial institutions to fund its weapons program.

The breach led to immediate withdrawal suspensions, triggering widespread panic. WazirX’s slow communication and frozen funds compounded investor anxiety, especially since the platform catered primarily to Indian retail traders.

Restructuring Efforts in Singapore

WazirX’s Singapore-based parent, Zettai Pte Ltd, sought a court-supervised restructuring to address the crisis. Its initial plan was rejected in June 2025 after it failed to disclose the creation of a Panama subsidiary, Zensui Corporation, raising concerns about transparency and governance.

An amended scheme has since been introduced, proposing pro-rata distribution of remaining assets through Zanmai India, registered with India’s Financial Intelligence Unit (FIU-IND). This shift is meant to align recovery efforts with Indian regulations. A revote on the plan is underway (July 30–August 6, 2025), with distribution promised within 10 business days if approved. Still, investors may recover only a portion of their funds.

Legal Setbacks in India

Meanwhile, 54 WazirX users filed a plea before the Supreme Court of India, citing losses of up to ₹2,000–₹4,500 crore. The Court dismissed the case, ruling it was not the right forum and directing petitioners to approach the RBI, SEBI, and CBI.

This marks a major setback for investors, who had already exhausted options in lower courts and the Delhi High Court. Allegations of negligence against WazirX’s leadership, including co-founder Nischal Shetty, remain unverified but continue to fuel distrust.

Investor Panic and Regulatory Gaps

The crisis has shaken investor confidence for multiple reasons:

● Unclear Ownership: A dispute between Binance and WazirX’s founders over ownership has left users unsure who bears responsibility.

● Foreign Jurisdiction: Legal remedies pursued in Singapore frustrate Indian investors, who feel excluded from protections under Indian law.

● Regulatory Vacuum: With the RBI distancing itself from regulating exchanges, a Delhi High Court judge called this stance “unfortunate,” leaving investors with little recourse.

● Uncertain Recovery: Even under the amended plan, full fund recovery is unlikely.

Analysis & Outlook

● The Singapore court’s rejection highlights stricter oversight on disclosure and accountability in crypto insolvency cases.

● The foreign jurisdiction of proceedings raises concerns over regulatory arbitrage and weakens Indian investor protections.

● For WazirX users, fund recovery remains uncertain, further eroding trust in centralized exchanges.

The WazirX saga underscores the fragility of crypto platforms without clear regulation, ownership, or investor safeguards. A combination of a major cyberattack, opaque corporate maneuvers, and reliance on foreign courts has left Indian investors in legal and financial limbo. The case highlights an urgent need for stronger domestic regulation, transparency, and accountability to restore confidence in India’s crypto ecosystem.

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.