AI and Automation Redefining Tax Compliance

Tax compliance is evolving at an unprecedented pace, driven by the growing complexity of global regulations and the rapid expansion of businesses into new markets and channels.

Traditional manual processes are no longer sufficient to manage the rising demands of indirect tax compliance, where even minor errors can result in significant audit risks and penalties.

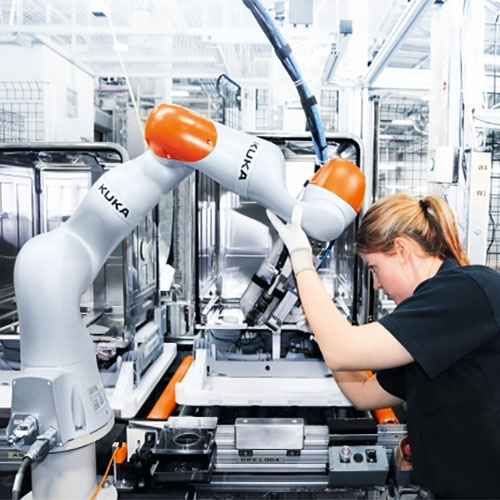

Artificial intelligence and automation are emerging as game changers, transforming how organizations approach compliance.

These technologies bring speed, accuracy, and scalability, enabling finance teams to shift from reactive problem-solving to proactive risk management.

By automating repetitive tasks such as data reconciliation, invoice matching, and tax determination, businesses can significantly reduce errors and free up resources for higher-value activities.

Moreover, AI-powered platforms can detect anomalies in real time, anticipate compliance risks, and adapt to changing regulations across multiple jurisdictions.

This ensures organizations remain compliant while minimizing disruptions.

As audit scrutiny intensifies, the ability to demonstrate transparency and accuracy becomes a competitive advantage.

Now is the time for businesses to embrace purpose-built tax compliance platforms.

Those that invest today will not only reduce audit risk but also achieve operational efficiency and scalability, positioning themselves to thrive in an increasingly complex regulatory environment.

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.