Global copper markets are heading into a period of acute stress as the explosive buildout of AI data-centres collides with slowing mine output. Analysts now warn that by 2035, the world may be able to meet only 70% of projected copper demand, according to the International Energy Agency’s latest critical minerals outlook.

Shortages, however, may arrive much sooner. Wood Mackenzie forecasts a 304,000-tonne refined-copper deficit in 2025, widening further in 2026. This tightening comes just as hyperscalers accelerate plans for massive AI campuses with unprecedented power requirements. Wood Mackenzie’s Charles Cooper told the Financial Times that tech giants are outbidding national grids for key equipment, including transformer units, adding intense pressure across the supply chain.

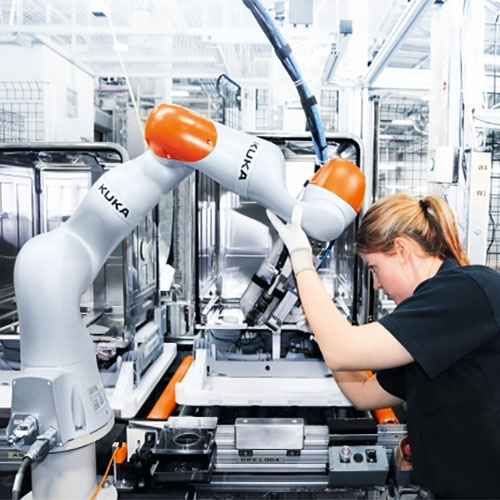

Modern AI campuses typically require 50–150 megawatts each. With copper usage estimated at 27–33 tonnes per megawatt, a single 100-MW site can consume several thousand tonnes before accounting for upstream grid upgrades. BHP’s case studies show more than 2,000 tonnes needed for an 80-MW installation alone.

Yet this demand surge is arriving as ore grades at legacy mines have dropped about 40% since 1991, reducing output and forcing operators to rely on aging sites or fight through years of environmental and land-use permitting. The FT highlights the struggle facing Arizona’s Resolution Copper project, stalled by tribal land disputes despite billions already invested and production still at least a decade away. Across Chile, Peru, and Indonesia, accidents, droughts, and community resistance are delaying key projects.

Copper prices have climbed above $11,000 per tonne, up from $8,500 two years ago, and new tariffs are reshaping global flows. Pre-tariff shipments into the U.S. have swollen domestic inventories while tightening supply elsewhere. JPMorgan expects elevated prices through 2026 as supply disruptions coincide with industrial and AI-driven demand.

With new mines and smelters slow to approve and even slower to build, the market is increasingly falling back on recycling, stockpiles, and incremental gains from existing operations. Urban-mining initiatives and reprocessing of old waste piles are gaining new urgency. Meanwhile, governments in the U.S. and Europe have placed copper on updated critical mineral lists, but large-scale smelting capacity remains scarce.

If AI adoption continues at its current pace, copper — once a background industrial commodity — may become one of the defining bottlenecks of the digital era.

See What’s Next in Tech With the Fast Forward Newsletter

Tweets From @varindiamag

Nothing to see here - yet

When they Tweet, their Tweets will show up here.